#mainContent a,#mainContent h3{font-weight:500!important}#mainContent h2{margin-top:3em;}#mainContent h3{margin-top:2.5em}#mainContent h3 span{font-weight: 300;letter-spacing:1px;}#mainContent h2{border-left:4px solid #3696da;padding:7px 0 7px 11px}ul.toc,ul.nextSteps{margin:.75em 0;list-style:none}ul.toc{padding:0 3.5em 2em; background:#f4f4f4;margin-top:0;border-left:4px solid #3696da;}ul.nextSteps{padding:0 .85em;margin-bottom:0px;margin-top:0}ul.toc li:before,ul.nextSteps li:before{content:””;border-style:solid;display:block;height:0;width:0;position:relative}ul.toc li:before{border-color:#3696da transparent transparent transparent;border-width:.35em .5em 0 .5em;left:-1.5em;top:.8em}ul.nextSteps li:before{border-color:transparent #ffab00;border-width:.5em 0 .5em .35em;left:-.85em;top:1.12em}#mainContent ul.toc li a,#mainContent ul.nextSteps li a{color:rgb(33,33,33);font-weight:300!important}#mainContent ul.nextSteps li a{border-bottom:2px solid #ffab00}#mainContent ul.nextSteps li a:hover{background:rgba(255,171,0,.3);text-decoration:none}<br /> Do you think a million-dollar term life insurance policy sounds like too much insurance?

As a Certified Financial Planner, I see underinsured people every day.

What do I tell them?

A million-dollar term life insurance policy might actually be the minimum coverage needed for the typical middle-class household, but it’s affordable.

That might sound like an exaggeration, but if you crunch the numbers – just as we’ll be doing a little bit – you’ll realize that a million-dollar policy might be just what you need.

The good news is term life insurance isn’t nearly as costly as most people think.

What makes term life insurance even better is that larger policies cost less on a per thousand basis than smaller policies do. You may find the premium on a $1 million policy is only a little bit higher than it is for $500,000.

Table of Contents

- Do You Really Need a $1 Million Term Life Insurance Policy?

- Choosing A Million Dollar Insurance Policy

- Factors That Affect How Much You Need

- Factors Affecting Your Life Insurance Premiums

- $1 Million Term Life Insurance vs Whole Life?

- $1 Million Life Insurance Rate Examples

- 10 steps to securing a million life insurance policy:

- The Best Companies to Purchase $1 Million Life Insurance

- Bottom Line: How Much Does A $1 Million Dollar Life Insurance Policy Cost?

- FAQ’s on $1 Million Life Insurance Policy

Do You Really Need a $1 Million Term Life Insurance Policy?

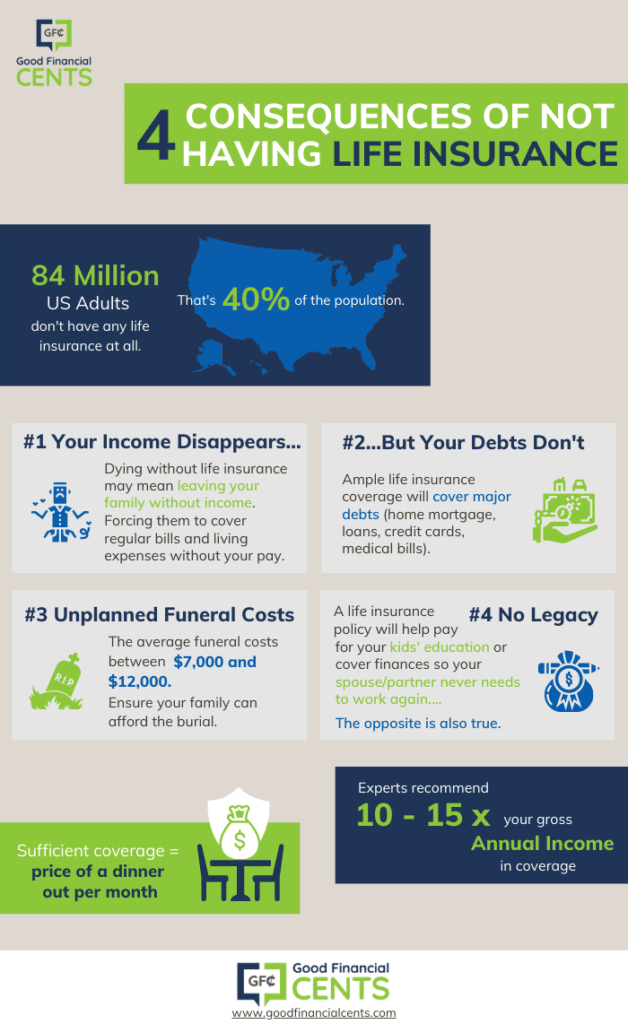

Probably, but let’s find out. A general rule of thumb is that you should get 10x your income as baseline coverage for life insurance.

If you’re young, that may be low because you may want to provide your family with enough to replace your income for 15 years or more.

Today, $1 million has become the new baseline for life insurance by a primary breadwinner. Anything less could leave your family financially impaired.

Typical Obligations to Add When Calculating the Amount You Need

Here’s a list of all the different obligations you may want to have life insurance cover in the unfortunate event you pass away early.

- Your Income (And for How Many Years)

- Your Final Expenses

- Any Debt You May Want to Be Settled

- Future Obligations Such as College for Children

- Other Obligations Such as Business

- Typical Items You Can Subtract When Calculating the Amount You Need

- Current Life Insurance Policies

- Assets (Like Cash or Stock) You Might Choose to Use Instead of Life Insurance

Now that you have an idea of these obligations, let’s punch them into this life insurance calculator to find out if you need a million-dollar policy.

if( typeof fbuilderjQuery == ‘undefined’ && typeof jQuery != ‘undefined’ ) fbuilderjQuery = jQuery.noConflict( );

cp_calculatedfieldsf_fbuilder_config_1={"obj":{"pub":true,"identifier":"_1","messages":{"required":"This field is required.","email":"Please enter a valid email address.","datemmddyyyy":"Please enter a valid date with this format(mm/dd/yyyy)","dateddmmyyyy":"Please enter a valid date with this format(dd/mm/yyyy)","number":"Please enter a valid number.","digits":"Please enter only digits.","max":"Please enter a value less than or equal to {0}.","min":"Please enter a value greater than or equal to {0}.","previous":"Previous","next":"Next","pageof":"Page {0} of {0}","audio_tutorial":"Help","minlength":"Please enter at least {0} characters.","maxlength":"Please enter no more than {0} characters.","equalTo":"Please enter the same value again.","accept":"Please enter a value with a valid extension.","upload_size":"The file you've chosen is too big, maximum is {0} kB.","phone":"Invalid phone number.","currency":"Please enter a valid currency value."}}};

form_structure_1=[[{"form_identifier":"","name":"fieldname3","shortlabel":"","index":0,"ftype":"fcurrency","userhelp":"Enter your annual income, before taxes. Do not include income from your spouse or other members of your household.","userhelpTooltip":false,"csslayout":"","title":"Annual Income","predefined":"","predefinedClick":false,"required":true,"readonly":false,"size":"small","currencySymbol":"$","currencyText":"","thousandSeparator":",","centSeparator":".","noCents":false,"min":"","max":"","formatDynamically":true,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname13","shortlabel":"","index":1,"ftype":"fslider","userhelp":"We suggest a minimum of 5 years. If you have kids, consider covering them until they are adults.","userhelpTooltip":false,"csslayout":"","title":"How many years should coverage last?","predefined":"5","predefinedMin":"","predefinedMax":"","predefinedClick":false,"size":"small","thousandSeparator":",","centSeparator":".","min":"1","max":"30","step":1,"range":false,"caption":"{0}","minCaption":"","maxCaption":"","fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname4","shortlabel":"","index":2,"ftype":"fcurrency","userhelp":"The total value of all liquid assets (bank and investment accounts). Do NOT include retirement accounts like 401(k)s or IRA.","userhelpTooltip":false,"csslayout":"","title":"Assets","predefined":"","predefinedClick":false,"required":true,"readonly":false,"size":"small","currencySymbol":"$","currencyText":"","thousandSeparator":",","centSeparator":".","noCents":false,"min":"","max":"","formatDynamically":true,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname5","shortlabel":"","index":3,"ftype":"fcurrency","userhelp":"Optional. Add an amount here if you want your life insurance to provide funds for your kidsu2019 education.","userhelpTooltip":false,"csslayout":"","title":"Amount for childrenu2019s education","predefined":"","predefinedClick":false,"required":false,"readonly":false,"size":"small","currencySymbol":"$","currencyText":"","thousandSeparator":",","centSeparator":".","noCents":false,"min":"","max":"","formatDynamically":true,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname6","shortlabel":"","index":4,"ftype":"fcurrency","userhelp":"Optional. Add an amount here if you want your life insurance to pay off existing debts, such as a mortgage, in a lump sum.","userhelpTooltip":false,"csslayout":"","title":"Amount for paying off debt","predefined":"","predefinedClick":false,"required":false,"readonly":false,"size":"small","currencySymbol":"$","currencyText":"","thousandSeparator":",","centSeparator":".","noCents":false,"min":"","max":"","formatDynamically":true,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname7","shortlabel":"","index":5,"ftype":"fcurrency","userhelp":"Optional. Add an amount here if you want your life insurance to pay off existing debts, such as a mortgage, in a lump sum.","userhelpTooltip":false,"csslayout":"","title":"Existing life insurance","predefined":"","predefinedClick":false,"required":false,"readonly":false,"size":"small","currencySymbol":"$","currencyText":"","thousandSeparator":",","centSeparator":".","noCents":false,"min":"","max":"","formatDynamically":true,"fBuild":{},"parent":""},{"form_identifier":"","name":"fieldname8","shortlabel":"","index":6,"ftype":"fButton","userhelp":"","userhelpTooltip":false,"csslayout":"","sType":"calculate","sValue":"Calculate","sOnclick":"","sLoading":false,"fBuild":{},"parent":""},{"form_identifier":"","name":"separator1","shortlabel":"","index":7,"ftype":"fSectionBreak","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"","fBuild":{},"parent":""},{"dependencies":[{"rule":"valueu003E1","complex":false,"fields":["fieldname1","fieldname9","fieldname10","fieldname11","fieldname12"]}],"form_identifier":"","name":"fieldname14","shortlabel":"","index":8,"ftype":"fCalculated","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"Hidden - Show Results","predefined":"","required":false,"size":"medium","eq":"fieldname3*0.7*fieldname13","suffix":"","prefix":"","decimalsymbol":".","groupingsymbol":"","readonly":true,"hidefield":true,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname1","shortlabel":"","index":9,"ftype":"fCalculated","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"After-tax income to replace","predefined":"","required":false,"size":"medium","eq":"PREC(fieldname3*0.7*fieldname13, 2)","suffix":"","prefix":"$","decimalsymbol":".","groupingsymbol":",","readonly":true,"hidefield":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname9","shortlabel":"","index":10,"ftype":"fCalculated","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"Optional coverage (debt & education)","predefined":"","required":false,"size":"medium","eq":"PREC(fieldname5+fieldname6, 2)","suffix":"","prefix":"$","decimalsymbol":".","groupingsymbol":",","readonly":true,"hidefield":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname10","shortlabel":"","index":11,"ftype":"fCalculated","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"Total coverage needed","predefined":"","required":false,"size":"medium","eq":"PREC(fieldname1+fieldname9, 2)","suffix":"","prefix":"$","decimalsymbol":".","groupingsymbol":",","readonly":true,"hidefield":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname11","shortlabel":"","index":12,"ftype":"fCalculated","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"Existing coverage (assets & insurance)","predefined":"","required":false,"size":"medium","eq":"PREC(fieldname4+fieldname7, 2)","suffix":"","prefix":"$","decimalsymbol":".","groupingsymbol":",","readonly":true,"hidefield":false,"fBuild":{},"parent":""},{"dependencies":[{"rule":"","complex":false,"fields":[""]}],"form_identifier":"","name":"fieldname12","shortlabel":"","index":13,"ftype":"fCalculated","userhelp":"","userhelpTooltip":false,"csslayout":"","title":"New life insurance needed","predefined":"","required":false,"size":"medium","eq":"PREC(fieldname10-fieldname11, 2)","suffix":"","prefix":"$","decimalsymbol":".","groupingsymbol":",","readonly":true,"hidefield":false,"fBuild":{},"parent":""}],{"0":{"title":"Life Insurance Calculator","description":"","formlayout":"top_aligned","autocomplete":0,"formtemplate":"","evalequations":0,"evalequationsevent":2,"persistence":0,"customstyles":""},"formid":"cp_calculatedfieldsf_pform_1"}];

Choosing A Million Dollar Insurance Policy

According to Policy Genius, the average cost for a 20-year $1 million term life insurance policy for a 35-year-old male is $53 per month. However, your rate will vary according to the following factors.

Factors that affect your rate:

- Your Age

- Your Health

- Your Gender

- Your Hobbies

- Your Coverage Amount and Policy Term

Where to start?

The best, and easiest place to start is online. I recommend having two or three insurers compete for your business to make sure you get the best rate and coverage. To see how cheap term life can be, choose your state from the map above to be matched with top life insurance providers instantly.

Factors That Affect How Much You Need

Let’s look at the individual components that can quickly add up to over a million-dollar policy.

Income Replacement

This is where things can get a bit intimidating. Even if you earn a modest income, you may need close to $1 million to replace that income after your death in order to provide for your family’s basic living expenses.

The conventional wisdom in the insurance industry is that you should maintain a life insurance policy equal to between 10 times and 20 times your annual income. So if you earn around $50K per year, that would mean policy coverage between $500K and $1 million.

The complication today is that with interest rates being as low as they are that might not be enough either.

For example, if you have a $1 million policy that could be invested at 5% per year, your family could live on the interest earned – which conveniently comes to $50,000 per year – for the next 20 years.

That would still leave the original $1 million intact to cover other expenses. But with today’s microscopic interest rates, there’s no way to get a guaranteed return of 5% on your money, certainly not for 15 or 20 years.

EXPERT TIP

Also, keep in mind that most insurance companies have a maximum multiplier you can apply to your income for life insurance coverage. For example, it wouldn’t make much sense for a 22-year-old making $27,000 per year to get a $2 million life insurance. Or a 65-year-old that is retired to secure a $3 million dollar policy.

The table below is approximately how much you’re allowed to multiply your income based on your age and income:

| Applicant’s Age | Annual Income Multiplier |

| 18-29 | 35x |

| 30-39 | 30x |

| 40-49 | 25x |

| 50-59 | 20x |

| 60-69 | 15x |

| 70-79 | 10x |

| 80+ | 5x |

Using the table above as a guide, a 35-year-old making $150,000 per year would be capped at taking out a $4.5 million term policy ($150,000 x 30 = $4,500,000).

Your Final Expenses

Here we start with the basics – wrapping up your final affairs.

This will include funeral costs and any lingering medical costs. A reasonable estimate for a typical funeral is around $20,000.

Crazy, right? You can get burial insurance to cover only the most basic of final expenses.

Outstanding Debt

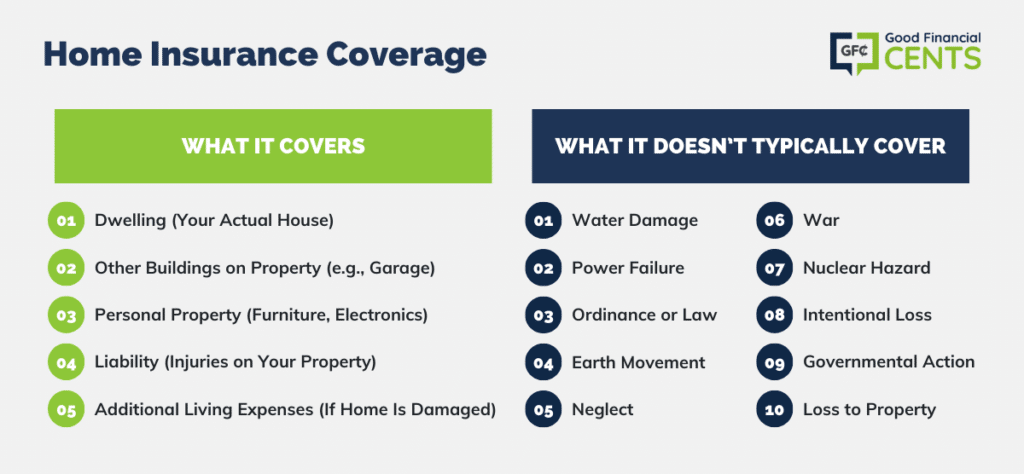

Debt burdens are high in the US, and debt can be especially crushing on remaining family members. Many life insurance customers make sure they can pay off most of their debt with the policy.

Medical Debt

Medical costs are a serious variable. Even if you have excellent health insurance, there are likely to be unpaid medical bills lingering after your death. This has to do with copayments, deductibles, and coinsurance provisions.

Collectively, they can add up to many thousands of dollars. But where things get really complicated is if you die of a terminal illness.

For example, if you are stricken by an illness that lasts for several years, you could incur a number of expenses that are not covered by insurance. This may include the cost of personal care and even experimental treatments.

Mortgage

A home may be a large asset, but it’s also often a homeowner’s largest debt. The average mortgage balance in the US is roughly $236,443 according to Experian data. So you could easily use a life insurance policy to pay off that debt and relieve your loved ones of a monthly mortgage payment.

Personal Debt

Credit card debt and other personal debt are some of the most expensive obligations carrying rates upward of 20% in some cases. Make sure you have enough to cover this very expensive debt.

Future Obligations For Your Family

Below is a sampling of major expenses your family is likely to incur, either on an annual basis or at some point after your death.

College

Tuition costs continue to skyrocket. The Department of Education suggests that four-year public college tuition has been rising an average of 5% per year, far exceeding the rate of inflation. If you have one child who attends an in-state public school, a second at an out-of-state public school, and a third in a private university, the total expenditure will reach $416,560.

- Annual cost at in-state public college: $20,770 ($83,080 for four years)

- Annual cost at out-of-state public college: $36,420 ($145,680 for four years)

- Annual cost at a private college: $46,950 ($187,800 for four years)

Transportation

Vehicles and other forms of transportation represent another large sum. Unfortunately, with increasing electronics and safety features, the average cost of a new car continues to grow.

Health Insurance

If your family relies on your work for healthcare, take notice. According to eHealth.com, the average health insurance premium for a family is $22,221. That’s a shade under $2,000 per month in additional cost. This cost will only rise, and the need could last for years.

Other Obligations You May Need to Cover

So far, we’ve been describing the financial obligations likely to affect a typical household.

But there may be certain situations that will produce obligations that are less obvious.

Business Owners

For example, if you’re a business owner, there may be debts or other financial obligations that will need to be paid upon your death.

Even though no one in your family may be qualified or interested in taking over your business, the payoff of those obligations may be completely necessary to enable the sale of the business.

Real Estate Investor

Another possibility is that you’re a real estate investor.

If your properties are heavily indebted, extra insurance proceeds may be necessary either to carry the properties until they’re sold, or even to pay off existing indebtedness to free up cash flow for income.

You may even need additional funds if you are taking care of an extended family member, like an aging parent.

These are just some of the many possibilities of expenses that will need to be covered by insurance proceeds.

Factors Affecting Your Life Insurance Premiums

Before we move on to specific life insurance quotes, let’s first consider the factors that affect term life insurance premiums.

Age

This is typically the single most important premium factor. The older you are, the more likely you are to die within the term of the policy.

Health

This is a close second and why it’s so important to apply for a policy as early in life as possible. Premiums on life insurances rates literally increase by each year.

If you have any health conditions that may affect mortality, such as diabetes or hypertension, your premiums will be higher. This is another compelling reason to apply while you are young and in good health.

It’s not that policies are not available to people with health conditions, it’s just that they’re less expensive if you don’t have any.

Policy Term

A 10-year term policy will have a lower premium than a 20-year term policy, which will be lower than a 30-year term. The shorter the term, the less likely it is the insurance company will have to pay a claim before it expires.

Policy Size

Size of the policy matters, but not the way you might think. Yes, a $1 million policy will cost more than a $500,000 policy. But it won’t cost twice as much.

The larger the policy, the lower the per-thousand cost will be.

When the size of the death benefit is considered, the larger policy will always be more cost-effective.

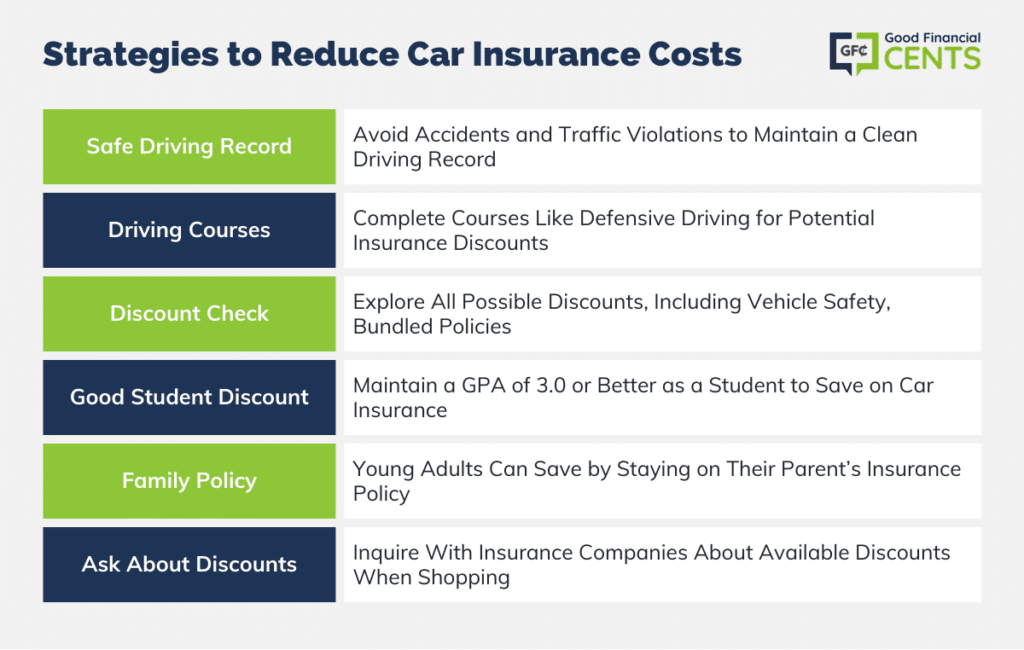

Work, Hobbies, and Habits

For example, certain occupations are more hazardous than others (think policeman versus librarian). Deep-sea diving is higher risk than golf. And smoking is the one activity guaranteed to raise your premiums substantially.

With this information in mind, let’s take a look at whether you should consider a $1 million whole life policy instead.

$1 Million Term Life Insurance vs Whole Life?

Any discussion on life insurance should include a comparison of whole life and term life insurance coverage. After all, both products can be immensely valuable in the right situation, yet one product (whole life) costs considerably more than the other.

Most of the time, the debate is settled in favor of term life insurance based on cost alone.

With that being said, whole life insurance and other investment-type life insurance coverage can be valuable in terms of the cash value you can build up over time. Whole life insurance also offers a fixed benefit amount for your heirs that will last for your entire life, yet the cost of your premiums are guaranteed to stay the same.

The cash value of a whole life insurance policy also grows on a tax-deferred basis, and you can borrow against this amount if you need a loan. Further, many whole life policies from reputable providers also pay out dividends during good years, which can be substantial.

Why Young Families Choose Term Coverage

The problem with whole life and other similar policies like universal life is the fact that premiums can be exorbitant for the amount of coverage you might need.

A couple with young children provides a good example since they might need a $1 million dollar policy or more to provide income protection for their working years and have money left for college tuition and other expenses.

With young families, expenses are already high.

This includes costs for food for a family, childcare, heavy use of health care, and the seemingly endless demand for clothing, furniture, and even entertainment as the children grow.

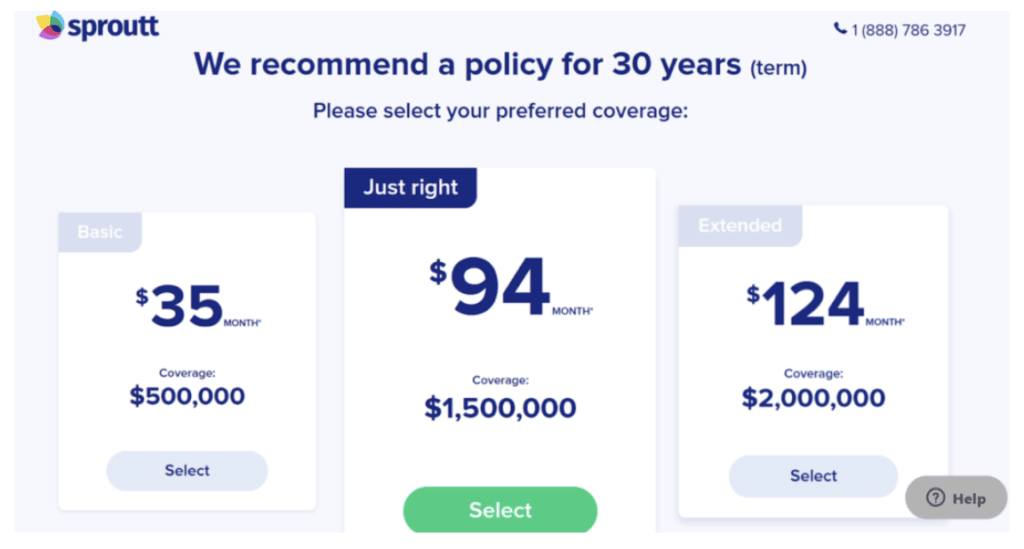

As you can see from the cost comparison below from State Farm, there’s not enough room in the typical family budget to afford the type of life insurance that’s needed.

A 40-year-old mother and breadwinner in excellent health would pay $80.09 per month for a term life policy that lasts 20 years, whereas a whole life policy in the same amount would cost $1,266.69 per month (or $14,560 annually).

This is a classic situation where term insurance rides to the rescue. The family can afford to buy the amount of coverage they need at an affordable price, whereas paying for permanent life insurance coverage in the same amount would be difficult to justify.

And just as important for people of any age and in any circumstance, the extra funds not being spent on insurance premiums can be invested to gradually improve your financial situation.

So absolutely, term insurance will work best for most people.

$1 Million Life Insurance Rate Examples

As you’ll notice, each table has a wide array of information. Knowing that everybody is in a different situation, I wanted to make sure that I offered term life quotes for almost every conceivable situation.

I’ve included life insurance rates for a 30-year term, 20-year term, and a 10-year term million dollar life policies. If you’re a tobacco user, I’ve also included some quotes from life insurance for smokers.

30-Year $1 Million Term Life Policy

For those that think that a million-dollar term policy is expensive, you’ll quickly notice that a 25-year-old male in good health only costs $645 per year while a 35-year-old costs $795.

On a monthly basis that’s almost next to nothing!

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 25 | MALE | BANNER LIFE $645 |

NORTH AMERICAN CO. $645 |

TRANSAMERICA $650 |

| 25 | FEMALE | AMERICAN GENERAL $514 |

NORTH AMERICA CO. $515 |

SBLI $520 |

| 35 | MALE | BANNER LIFE $795 |

GENWORTH FINANCIAL $804 |

ING $808 |

| 35 | FEMALE | SBLI $640 |

AMERICAN GENERAL $694 |

GENWORTH FINANCIAL $695 |

| 45 | MALE | BANNER LIFE $1,885 |

GENWORTH FINANCIAL $1891 |

AMERICAN GENERAL $1,894 |

| 45 | FEMALE | SBLI $1,450 |

BANNER LIFE $1,455 |

AMERICAN GENERAL $1,456 |

20-Year $1 Million Term Life Policy

There is a big drop-off in life insurance rates between a 20 year and a 30 year since underwriters do not have to worry as much about life expectancy.

For many people, a 20-year policy gets them exactly where they want to be in life when the policy term runs out.

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 25 | MALE | AMERICAN GENERAL $414 |

BANNER LIFE $425 |

SBLI $440 |

| 25 | FEMALE | AMERICAN GENERAL $354 |

SBLI $360 |

BANNER LIFE $365 |

| 35 | MALE | SBLI $450 |

BANNER LIFE $455 |

NORTH AMERICA CO. $485 |

| 35 | FEMALE | SBLI $390 |

AMERICAN GENERAL $404 |

BANNER LIFE $405 |

| 45 | MALE | BANNER LIFE $1,155 |

SBLI $1,160 |

GENWORTH FINANCIAL $1,173 |

| 45 | FEMALE | SBLI $880 |

BANNER LIFE $895 |

TRANSAMERICA $930 |

10-Year $1 Million Term Life Policy

Once again, you get a $200 drop in the annual premium by losing another 10 years on the term.

If your life insurance agent isn’t giving you all these term options and is only focused on the death benefit, then you need a different agent.

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 25 | MALE | SBLI $260 |

BANNER LIFE $285 |

MINNESOTA LIFE $290 |

| 25 | FEMALE | SBLI $230 |

BANNER LIFE $245 |

ING $248 |

| 35 | MALE | SBLI $270 |

BANNER LIFE $295 |

MINNESOTA LIFE $300 |

| 35 | FEMALE | SBLI $240 |

BANNER LIFE $255 |

ING $258 |

| 45 | MALE | BANNER LIFE $585 |

TRANSAMERICA $630 |

GENWORTH FINANCIAL $637 |

| 45 | FEMALE | SBLI $520 |

BANNER LIFE $525 |

ING $528 |

$1 Million Policy for Smokers – Rates Increase

For all you smokers out there – beware! The cost of your life insurance balloons as you’ll see here. If you’re considering kicking the habit, now is as good time as any.

Some life insurance companies will give you a lower rate if you complete a recognized smoking cessation program, and go on without smoking for at least two years.

It won’t help your immediate situation, but when you see the premium on smoker life insurance rates below, you might agree that it’s something to work toward!

| AGE | SEX | COMPANY 1 | COMPANY 2 | COMPANY 3 |

|---|---|---|---|---|

| 35 | MALE | North American Co. $3595 |

SBLI $3630 |

MetLife $3639 |

| 35 | FEMALE | North American Co. $2555 |

Transamerica $2720 |

Prudential $2765 |

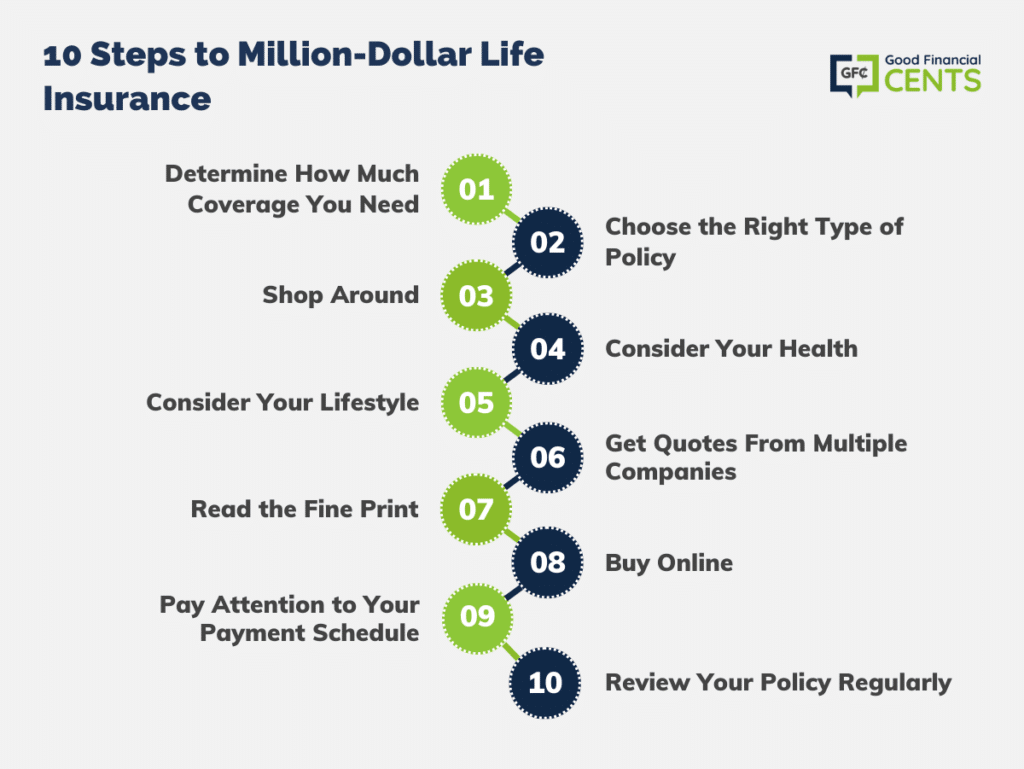

10 steps to securing a million life insurance policy:

If you’ve made the decision that $1 million of life insurance is the right amount of coverage you need and you’re ready to purchase a policy, here are the steps you’ll need to follow.

1. Determine How Much Coverage You Need: This is the first and most important step in securing a million life insurance policies. You need to have a clear understanding of how much coverage you actually need.

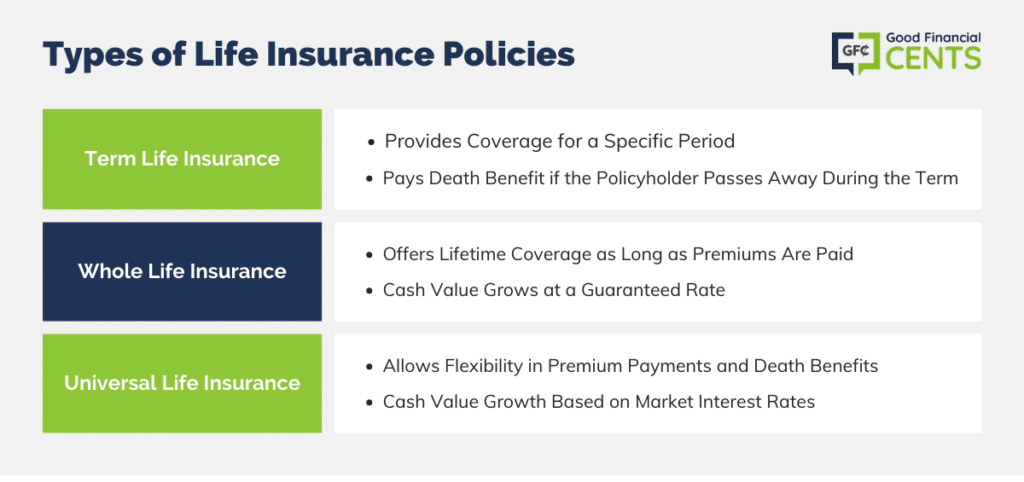

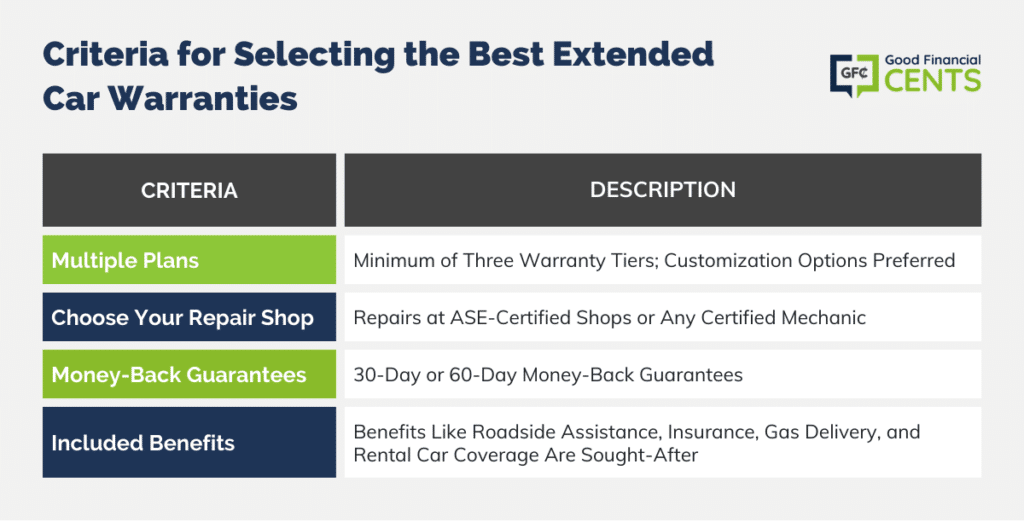

2. Choose the Right Type of Policy: There are whole life, term life, and Universal life policies available. Choose the one that best suits your needs.

3. Shop Around: Don’t just go with the first life insurance company you come across. It’s important to compare life insurance rates and coverage from a few different companies before making a decision.

4. Consider Your Health: If you’re in good health, you’ll likely qualify for lower rates. However, if you have health issues, you may still be able to get coverage, but it will probably be more expensive.

5. Consider Your Lifestyle: If you have a risky job or hobby, that could affect your rates.

6. Get Quotes From Multiple Companies: This is the best way to compare rates and find the cheapest policy.

7. Read the Fine Print: Make sure you understand all the terms and conditions of the policy before buying it.

8. Buy Online: You can usually get cheaper rates by buying life insurance online.

9. Pay Attention to Your Payment Schedule: Most life insurance policies require monthly or annual payments. Be sure you can afford the payments before buying a policy.

10. Review Your Policy Regularly: Life changes, and so do life insurance needs. Be sure to review your policy regularly to make sure it still meets your needs.

Following these steps will help you get the best possible rate on a million-dollar life insurance policy.

Make sure you understand all the terms and conditions before signing on the dotted line. Also, make sure to shop around and compare rates from multiple companies before buying a policy.

Yes, I know I’ve said that a few times in this article, but it’s worth repeating. Many people go with the first life insurance company they call, and that isn’t kind to their checkbook. It pays to shop around.

Here’s what you need to know about choosing the best life insurance company for your $1 million policy:

The Best Companies to Purchase $1 Million Life Insurance

When choosing the best life insurance company, it’s important to consider the overall financial health of the insurance company. You want to make sure the company you choose is stable and will be around for years to come. You also want to consider things like the company’s customer service rating and claims-paying ability.

There are a lot of different life insurance companies out there, so it can be difficult to know which one is the best. Each company is rated by different organizations, so it’s important to look at multiple ratings before making a decision.

The companies that rate insurance companies are A.M. Best, Moody’s, and Standard & Poor’s.

A.M. Best is a credit rating agency that specializes in the insurance industry. They rate insurance companies on their financial stability.

Moody’s is another credit rating agency. They also rate insurance companies on their financial stability.

Standard & Poor’s is a credit rating agency that rates companies on their financial stability.

The following life insurance companies are all rated A+ (Superior) by A.M. Best and are considered to be financially stable and have a good claim-paying ability.

1. Northwestern Mutual

2. New York Life

3. MassMutual

4. Guardian Life

5. State Farm

6. Nationwide

7. USAA

8. MetLife

9. The Hartford

10. Allstate

Here are those same top life insurance companies with their respective ratings:

| Company | AM Best | Moody’s | Standard & Poor’s |

| Northwestern Mutual | A++ | Aaa | AA+ |

| New York Life | A++ | Aaa | AA+ |

| MassMutual | A++ | A2 | AA+ |

| Guardian Life | A++ | Aa2 | AA+ |

| State Farm | A++ | A1 | AA |

| Nationwide | A+ | A1 | A+ |

| USAA | A++ | Aa1 | AA+ |

| MetLife | A- | A3 | A- |

| The Hartford | A+ | A1 | A+ |

| Allstate | A+ | A3 | A- |

These are just a few of the many life insurance companies out there that could provide you with a $1 million life insurance policy.

When choosing a life insurance company, it’s important to consider their financial stability, customer service rating, and claims-paying ability. The companies listed above are all rated A+ (Superior) by A.M. Best and are considered to be financially stable with a good claims-paying ability.

Northwestern Mutual, New York Life, MassMutual, Guardian Life, State Farm, Nationwide, USAA, MetLife, The Hartford, and Allstate are all good choices for life insurance companies.

You can’t put a price on peace of mind, and with a $1 million life insurance policy you can have the peace of mind knowing that your loved ones will be taken care of financially if something happens to you.

Bottom Line: How Much Does A $1 Million Dollar Life Insurance Policy Cost?

Getting a one-million-dollar term life insurance policy is not as expensive as most people believe. You can start getting quotes today from a variety of top life insurers by selecting your state from the map above.

Even those who opt for the more expensive permanent life insurance policy will many times be surprised at the price.

Either way, you can get these larger amounts of coverage and still not break the bank. But get your policy now, while you’re still young and in good health.

FAQ’s on $1 Million Life Insurance Policy

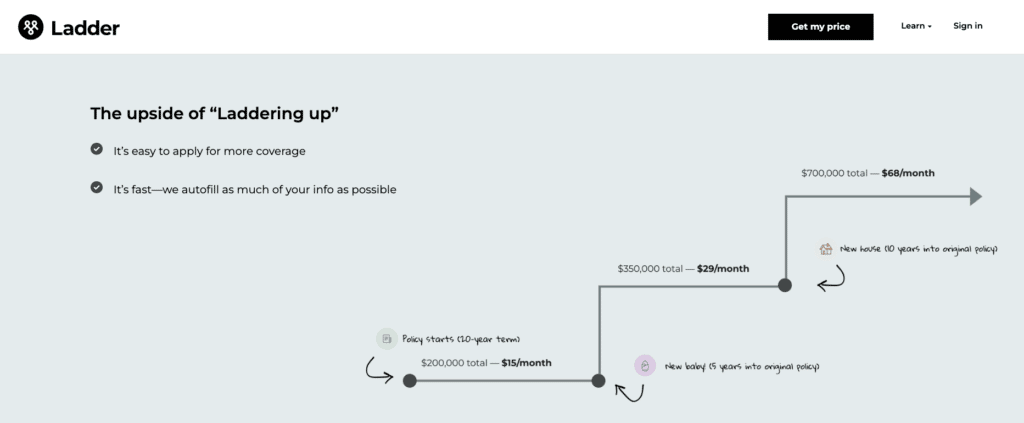

The cost of a $1,000,000 life insurance policy will vary based on factors like your age, health, and lifestyle. However, you can expect to pay around $250 per year for a healthy 30-year-old. According to Ladder Life, a $1 million term life policy for healthy 30-year-old males costs around $2.08 per day.

A $1 million term life insurance policy is a type of life insurance that provides coverage for a specific period of time, usually 10-20 years. If you die during the term of the policy, your beneficiaries will receive a death benefit of $1 million. If you live past the term of the policy, the policy will expire and you will not receive any death benefit.

A $1 million term life insurance policy is a good choice for people who want to make sure their loved ones are taken care of financially if something happens to them. It can also be a good choice for people with a lot of debt, like a mortgage or student loans, that they want to make sure is paid off if they die.

For the most part, yes; but there are examples of people who cannot buy life insurance. For instance, people with a terminal illness or those who have been diagnosed with a life expectancy of fewer than two years are not able to purchase life insurance policies.

The other factors are your income, affordability, and suitability. If you cannot afford the premiums, then you will not be able to purchase the policy. And if your income is say less than $50,000 then the insurance company may not think it’s suitable to purchase a $1 million life insurance policy.

A million-dollar life insurance policy may not be right for everyone, but it can be a good idea if you have a lot of debt or if you want to make sure your family is taken care of financially if something happens to you.

No one likes to think about their death, but it’s important to have a life insurance policy in place in case something happens to you. A million-dollar life insurance policy can give you and your loved one’s peace of mind knowing that they will be taken care of financially if something happens to you.

There is no one-size-fits-all answer to this question, as the best policy for you will depend on your specific needs and preferences. However, some of the top providers of million-dollar life insurance policies include AIG, Banner Life, and Prudential. So be sure to explore your options and compare quotes from different providers before making a decision.

Yes, insurance companies offer million-dollar insurance policies with no medical exam. However, the premiums for these policies are typically much higher than for policies with a medical exam.

The post How Much Does A Million Dollar Life Insurance Policy Cost? appeared first on Good Financial Cents®.