Deciding whether to continue with your life insurance policy or cancel it is not just a significant financial choice, it can also have profound emotional implications.

After all, life insurance isn’t just a monetary consideration – it’s about ensuring that your loved ones are protected in case of your untimely demise.

However, sometimes circumstances may lead you to contemplate canceling your life insurance policy. The question then arises: should you, and if so, how do you go about it? Let’s delve deeper.

Table of Contents

- Understanding Life Insurance Policies: More Than Meets the Eye

- Reasons for Canceling Life Insurance: Making the Tough Call

- Considerations Before Canceling Your Life Insurance: Weigh Your Options

- How to Cancel Your Life Insurance: Following the Right Steps

- Life After Canceling Your Life Insurance: Managing Your Risks

- Conclusion – Canceling Life Insurance: A Guide

Understanding Life Insurance Policies: More Than Meets the Eye

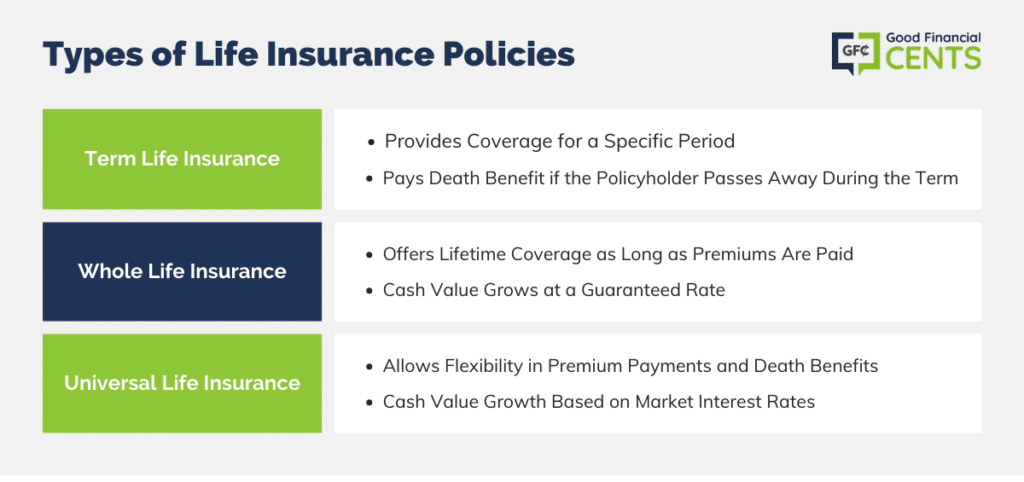

First off, to make an informed decision, it’s crucial to understand the two main types of life insurance policies that are on the market.

Term Life Insurance: The Straightforward Option

As its name suggests, term life insurance provides coverage for a specified term, which typically ranges from 10 to 30 years. If you pass away during this term, your designated beneficiaries receive the policy’s death benefit.

This type of insurance is often viewed as the simpler and more affordable option, as it strictly provides coverage without any investment component.

Permanent Life Insurance: Coverage Plus Investment

On the other hand, permanent life insurance policies, such as whole life or universal life insurance, provide coverage for your entire lifetime and include an investment element known as cash value.

This cash value portion grows over time and can be borrowed against or even surrendered for cash, making this type of policy more complex and usually more expensive.

Reasons for Canceling Life Insurance: Making the Tough Call

Several scenarios might lead you to contemplate canceling your life insurance policy.

Financial Reasons: When the Premiums Are Too High

It could be that the premiums have become unaffordable due to changes in your financial circumstances.

As the cost of living increases, especially in the light of rising inflation, as highlighted in a recent FT Adviser report, it’s not uncommon for individuals, especially those over 50, to consider cutting back on their life insurance.

Policy No Longer Needed: When Life Takes a Better Turn

Your reasons for canceling could also be positive. Maybe your children have grown up and become financially independent, or your financial status has improved significantly since you first took out the policy.

Reasons for Canceling Life Insurance

| REASONS | DESCRIPTION |

|---|---|

| Financial Reasons | High Premiums Due to Changed Financial Circumstances |

| Policy No Longer Needed | Improved Financial Status or No Longer Supporting Dependents |

Considerations Before Canceling Your Life Insurance: Weigh Your Options

But before you make the decision to cancel your life insurance policy, there are several factors to consider.

Evaluate Your Current Situation: Checking the Safety Net

Firstly, evaluate your current financial situation. You should be sure that you and your dependents won’t need the safety net that life insurance provides in the future.

Understand Potential Consequences: The Trade-Offs

It’s important to understand the potential consequences of canceling your life insurance. If you cancel your term life insurance, you won’t receive any money back and will be left without coverage.

On the other hand, canceling a permanent life insurance policy might allow you to recover some of the cash value, but could also result in surrender charges, especially if the policy is still in its early years, as pointed out by a Forbes Advisor article.

Alternatives to Canceling: Is There a Middle Ground?

Before canceling your policy outright, it’s worth exploring other options. For instance, you could reduce the death benefit to lower the premiums or even switch to a more affordable term life insurance policy if you currently have a permanent life insurance policy.

How to Cancel Your Life Insurance: Following the Right Steps

If, after considering all the implications and alternatives, you still decide that canceling your life insurance is the best course of action, then here are the steps you need to take.

Steps to Cancel Term Life Insurance: It’s All About Communication

The process for canceling term life insurance is generally straightforward. First, you need to contact your insurance provider and inform them of your intention to cancel the policy. This could be over the phone, via email, or sometimes through an online portal.

Steps to Cancel Permanent Life Insurance: A Bit More Complex

The process of canceling a permanent life insurance policy, on the other hand, could be a bit more complex, particularly because of the cash value component. You may need to complete a policy surrender form or send a written request to your insurance provider.

Remember:

Always confirm the details with your insurer, and remember that you might be entitled to receive some of the policy’s cash value upon surrendering the policy.

Life After Canceling Your Life Insurance: Managing Your Risks

The aftermath of canceling your life insurance policy requires careful financial planning. Now that you no longer have the protection that the policy provided, you need to manage the financial risk that the policy once covered.

Managing Financial Risk: New Strategies

This risk management could involve several strategies, from building an emergency fund to investing for your long-term financial goals.

Setting up an Emergency Fund: An Essential Buffer

An emergency fund is an essential financial tool that provides a buffer against sudden expenses or financial emergencies. It ensures that even if unexpected costs arise, you have a financial cushion to rely on.

Investing for Long-term Goals: Playing the Long Game

By investing, you can grow your wealth over time and work towards achieving your financial goals. Whether it’s retirement planning, saving for a home, or investing in your child’s education, having a robust investment strategy can provide financial security in the long run.

Conclusion – Canceling Life Insurance: A Guide

Canceling your life insurance policy is a significant decision that should be made with careful consideration. It’s crucial to weigh the potential risks and benefits, evaluate your current and future financial situation, and explore all available alternatives.

REMEMBER:

The post Canceling Your Life Insurance Policy: A Comprehensive Guide appeared first on Good Financial Cents®.