The best home insurance companies offer high-quality coverage that protects against damage to your home’s structure and your property, whether it is caused by lightning, winds, fire, or other covered perils.

Homeowners’ insurance also comes with important liability coverage that can save you financially if someone is injured on your property and decides to sue you for damages.

That said, not all homeowners insurance is created equal, and the best home insurance companies stand out due to the breadth of their policy offerings, the discounts they offer, and their affordable premiums.

To help you find the best home insurance company for your needs and your budget, we compared more than 20 of the top providers based on these factors, as well as third-party rankings from agencies like A.M. Best and J.D. Power.

Our Picks for Best Home Insurance of May 2024

Table of Contents

- Lemonade: Best Online Insurance Company

- Liberty Mutual: Best for Customized Coverage

- Progressive: Best for Comparison Shopping

- Hippo: Best for Fast Quotes

- Travelers: Best Green Savings Option

- Farmers: Best for Discounts

- USAA: Best for Military

- Allied: Best for Flexible Coverage

- Erie Insurance: Best Customer Experience

- Amica Mutual: Best for Claims Satisfaction

Best Home Insurance – Company Reviews

These are the best homeowners insurance companies for 2024 based on their coverage options, customer satisfaction scores, available discounts, and more. That said, it’s worth noting that not all of these home insurance companies offer their products nationwide.

Lemonade offers instant home insurance quotes without any hassle, and their rates start at just $25 per month. This insurance company operates online and through its mobile app, which boasts an average rating of 4.6 stars on Google Play and 4.9 out of 5 stars in the App Store.

Because Lemonade uses newer technology, it can provide speedy insurance quotes with just a few clicks of a button. It also promises an incredibly fast claims process with 24/7 customer service. Although the bulk of its insurance claims are handled electronically, Lemonade also offers human customer service agents who can answer questions along the way.

With Lemonade, you have the chance to customize coverage to meet your needs. Its homeowners’ insurance policies can include coverage for your dwelling, other structures, personal belongings, medical payments to others, loss of use, and personal liability.

Liberty Mutual has been in operation since 1912, so the company has more than a century of experience in the insurance space. This provider is also known for letting customers customize policies so they can “pay for only what they need” when it comes to home insurance and other products they provide.

While Liberty Mutual home insurance includes automatic dwelling coverage and personal liability, you have the option to add on items like personal property coverage for replacement cost and water backup and sump pump overflow coverage. Customers can also get a 10% discount for purchasing their policies online. Homebuyers can also get a discount on insurance for their new home.

In business since 1937, Progressive isn’t exactly new in the neighborhood. That said, the company has grown steadily in reputation and market share in recent decades.

We like Progressive because it’s easy to access customer service representatives online or by phone if you prefer. Also, it goes without saying the company has some of the highest grades from independent agencies when it comes to its financial strength.

Also, note that Progressive is one of the only home insurance companies that lets you compare rates across multiple homeowners insurance providers in one place.

Hippo prides itself on its “top-notch customer service,” and they are willing to help you through the claims process. While this company started out offering coverage in only 12 states nationwide, Hippo now offers affordable homeowners insurance in 37 different states.

Hippo makes it easy to get a free quote for home insurance online, and they say you can save up to 25% off homeowners insurance when compared to their competitors. Hippo also offers a “Hippo Smart” program in some states that lets customers qualify for a discount on insurance premiums when they install eligible home monitoring and security systems.

Originally founded in 1864, Travelers has been in operation for longer than most other home insurance companies in operation today. Based in New York City, Travelers Insurance writes policies throughout the nation, which is an important factor for homeowners shopping for new coverage.

With customers all over the country, a company can also more easily absorb disasters such as hurricanes that create a large volume of claims in a short period of time. Independent insurance rating agencies such as A.M. Best and Moody’s also like Travelers, giving it consistently high marks for stability.

Farmers is another nationwide company that earned its spot in our ranking of best home insurance companies. Based in California, Farmers has been tested, and it continues to excel.

This company provides basic home insurance for your dwelling as well as liability coverage, but you can customize your plan with add-on coverage for things like “green” replacement coverage and identity theft protection. A feature called “declining deductible” also lets you earn $50 toward your deductible each year your policy is in force.

We’re particularly attracted to the discounts you can get by having newer safety features on your home or by living in a newly constructed home. Farmers have also received strong ratings for financial strength from A.M. Best, so you can rest assured your eligible claims will be honored.

Unless you’re on active duty, a veteran, or a family member of a military member or veteran, you won’t have access to USAA’s home insurance rates or customer service. But if you are already a USAA member, you can find some of the best homeowners insurance and customer service on the market. Even with its limited pool of potential policyholders, we think highly enough of this company to add them to our ranking.

Standard & Poor’s and A.M. Best think USAA is top-notch as well, giving USAA their highest ratings for financial stability. Further, USAA received the top ranking for customer satisfaction in J.D. Power’s 2021. U.S. Home Insurance Study, as well as in J.D. Power’s 2021 U.S. Property Claims Satisfaction Study.

Allied Insurance, part of the Nationwide Insurance family, offers solid, flexible coverage at competitive rates. If you prefer getting answers to questions by telephone, you’ll appreciate Allied’s approach to customer service. Also, note that Allied lets you choose from flexible coverage options with the potential to customize your standard home insurance policy to suit your unique needs as well as your budget.

Since policies are backed by Nationwide, which has nine decades of experience, Allied is a reliable and stable partner. If you’re already a Nationwide customer, ask about multi-policy discounts and claim-free discounts.

With one of the lowest customer complaint ratios and an A+ rating from the Better Business Bureau (BBB), Erie has the makings of a great homeowners insurance partner if you live in an area it serves. A.M. Best gives Erie an A+, one of its highest marks, for financial stability, too.

Erie Home Insurance excels at customer service, and its coverage is strong, too. In fact, Erie Insurance earned the 4th highest ranking across all major home insurance companies in J.D. Power’s 2021. U.S. Home Insurance Study.

Amica Mutual may not have the name recognition of some of our other favorites, but it keeps moving up the list because of consistent praise for its customer service and speedy claims process. In fact, Amica Mutual received exceptional ratings from J.D. Power for customer satisfaction and claims satisfaction in 2021. Both of these studies rely on the user experiences of past customers to form their rankings.

Amica gets high marks for its financial stability, too. They may not do much in terms of national advertising and brand management, but people throughout the country continue to hear about this century-old firm.

Home Insurance Guide

Before you invest in a homeowners insurance policy, you should learn more about home insurance products and how they work. You should also arm yourself with information when it comes to insurance claims and what home insurance policies typically cover.

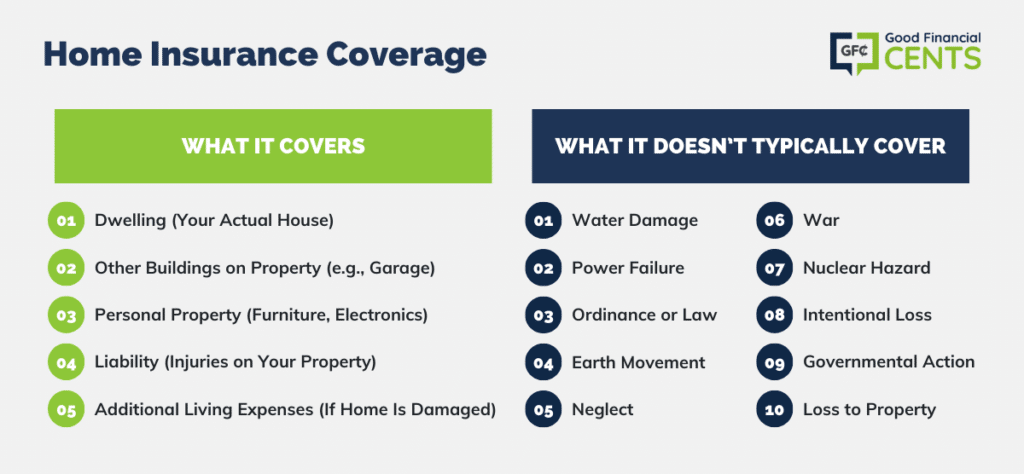

What Does Home Insurance Cover?

Just like auto insurance, homeowners insurance offers a variety of protections for various aspects of your property.

Your homeowners’ insurance should protect:

- Your dwelling, which is a term insurers use for your actual house

- Other buildings on your property, such as a detached garage or storage building

- Your personal property, such as furniture, electronics, and appliances

- Your liability in case someone gets injured on your property

- Your additional living expenses in case damage to your home requires you to move out for a while

These protections seem straightforward enough at first glance, but when buying coverage, you’ll need to make sure you know exactly what is included. Also, note that some home insurance companies include more features as standard in their policies than others. With that in mind, don’t be afraid to customize your homeowners’ insurance with additional coverage options you believe you could benefit from.

What Doesn’t Home Insurance Cover?

Whether you have a named peril policy or an open peril policy can have a direct impact on whether the disaster that destroyed or damaged your home qualifies for insurance coverage.

- Named peril policies cover only damage from the perils listed in your policy, whether they’re natural disasters such as windstorms, fire damage from wildfires, and volcanic eruption, or man-made, such as vandalism and civil unrest.

- Open peril policies cover all damages unless from perils specifically excluded in the policy.

Typically, a named-peril policy costs less because it’s up to the insured to prove property damages resulting from a covered peril. Meanwhile, open peril policies cost more because they can potentially cover a wider range of damages.

The exact inclusions of your homeowners’ insurance coverage depend on the specifics of your policy and the home insurance company you purchase from. However, an array of events are typically excluded from home insurance. These can include:

- Water damage

- Power failure

- Ordinance or law

- Earth movement

- Neglect

- War

- Nuclear hazard

- Intentional loss

- Governmental action

- Loss to property

In many cases, homeowners can buy add-ons or extra coverage that provides more protection in areas that are typically not covered with a traditional homeowners insurance policy. These are also called endorsements.

For example, it’s possible to buy flood insurance and earthquake insurance in many areas of the country. As we mentioned already, an open perils policy can also provide broader insurance protection for your home and property.

How Much Is Home Insurance?

Generally speaking, home insurance is one of the major costs of owning a home outside of the purchase price and property taxes. Homeowners’ insurance rates vary based on information such as the location and size of your home, the materials your home is built from, other structures on the property, the policy limits you require for your coverage, your home insurance deductible, credit score, and more.

Every insurer also has its own discounts, whether for home security devices like burglar alarms, for installing sprinkler systems, or for bundling in other products, such as life insurance or auto insurance.

That said, a 2021 National Association of Insurance Commissioners (NAIC) report states that the national average cost of homeowners insurance worked out to $1,249 per year, or $104.08 per month, at last count.

If you’re curious to find out home insurance costs based on where you live and the property you want to insure, your best bet is shopping around and comparing quotes from at least three of the best home insurance companies. You should plan on shopping around for insurance just like you did when you were wondering how to get approved for a home loan.

How to Find the Best Home Insurance Coverage

One of the most crucial steps to finding affordable insurance is shopping for quotes. In fact, you should shop for homeowners policy in the same way you shopped around for the best mortgage rates.

Whether you’re shopping for homeowners coverage, renters insurance, or auto insurance policies, Gabi should be at the top of your list. Gabi is a free platform that provides home and auto insurance shoppers with quick rates from leading providers, showing them just how much they can save on their policies. In a matter of minutes, you get access to up to twenty quotes and the option to switch your policy seamlessly.

While using this platform to compare home insurance policies can help you see how pricing stacks up across multiple providers, there are other details to keep in mind. For example, you’ll want to make a true “apples to apples” comparison across providers to make sure you’re getting the same types of coverage and similar policy limits.

You’ll also want to know whether you are buying named perils coverage or open perils coverage, as well as whether policies are offering replacement cost coverage or actual cash value coverage.

Methodology: How We Found the Best Home Insurance Companies

To find the best homeowners insurance providers, we compared companies based on satisfaction ratings from third-party agencies like J.D. Power and financial strength ratings from A.M. Best. We also looked for home insurance companies that offer broad coverage options that allow customization, as well as companies that offer at least five major discounts that can help customers save on premiums.

Finally, we looked for home insurance companies that offer protection in most states, as well as the ability to get a free home insurance quote online.

Summary of the Best Home Insurance Companies

- Lemonade: Best Online Insurance Company

- Liberty Mutual: Best for Customized Coverage

- Progressive: Best for Comparison Shopping

- Hippo: Best for Fast Quotes

- Travelers: Best Green Savings Option

- Farmers: Best for Discounts

- USAA: Best for Military

- Allied: Best for Flexible Coverage

- Erie Insurance: Best Customer Experience

- Amica Mutual: Best for Claims Satisfaction

Bottom Line – Best Homeowners Insurance Companies of 2024

In 2024, selecting the best homeowners insurance is imperative for safeguarding one’s property and financial interests. Quality home insurance provides coverage for damage from numerous perils and liability in case of accidents on your premises.

With a plethora of providers in the market, a few shine through due to their comprehensive policy offerings, attractive discounts, and cost-effective premiums.

Among the standout companies are Lemonade, renowned for its online efficiency; Liberty Mutual, with over a century of trusted service; and Progressive, for its rate comparison feature.

Others like Hippo, Travelers, Farmers, USAA, Allied, Erie Insurance, and Amica Mutual each bring unique offerings to cater to diverse customer needs.

However, always ensure you understand the nuances of what’s covered and what’s not, and don’t hesitate to customize your policy based on individual requirements.

The post Best Homeowners Insurance Companies of 2024 appeared first on Good Financial Cents®.